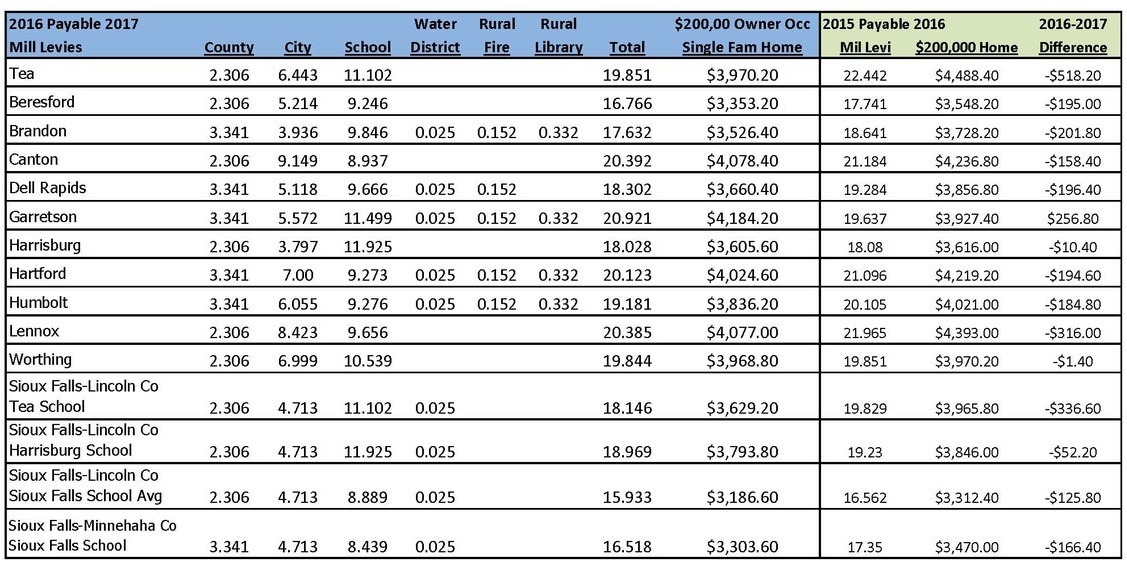

south dakota property tax rates by county

South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales taxClick any locality for a full breakdown of local. The states laws must be adhered to in the citys handling of taxation.

South Dakota Sales Tax Small Business Guide Truic

You can look up your recent.

. The median property tax in Potter County South Dakota is 863 per year for a home worth the median value of 55600. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

The median property tax also known as real estate tax in Jackson County is 78300 per year based on a median home value of 5460000 and a median effective property tax rate of. Taxation of properties must. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

The median property tax in Hyde County South Dakota is 987 per year for a home worth the median value of 66600. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. Adhesive top selling original.

Gregory County collects on average 141 of a propertys assessed. The median property tax also known as real estate tax in Haakon County is 72400 per year based on a median home value of 7480000 and a median effective property tax rate of. If the county is at 100 of full and true value then the equalization.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. South Dakota Property Tax Rates. All property is to be assessed at full and true value.

Then the property is equalized to 85 for property tax purposes. Colorado State Income Tax Rate Reduction Initiative. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Potter County collects on average 155 of a propertys assessed. Stanley County collects on average 109 of a propertys assessed.

2022 List of South Dakota Local Sales Tax Rates. State Summary Tax Assessors. Ultimate Magnetic Toolbox Labels Blue.

South Dakota Property Tax Rates. Dewey County South Dakota. The median property tax in Gregory County South Dakota is 791 per year for a home worth the median value of 56100.

Hyde County collects on average 148 of a propertys assessed fair. To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. Then the property is equalized to 85 for property tax purposes.

In the year 2020 property owners will be paying 2019 real estate taxes. The median property tax also known. Minnehaha County collects on average 142 of a propertys.

Brule County collects on average 112 of a propertys assessed fair. Proposition 121 seeks to decrease the state income tax rate from 455 percent down to 440 percent from January 1. This data is based on a 5-year study of median property tax.

Average Sales Tax With Local. Ultimate Magnetic Labels Green NEW Adhesive in Blue. The median property tax in Stanley County South Dakota is 1244 per year for a home worth the median value of 113700.

The median property tax in Brule County South Dakota is 982 per year for a home worth the median value of 87300. The median property tax in Minnehaha County South Dakota is 2062 per year for a home worth the median value of 144900. Counties in South Dakota collect an average of 128 of a property.

The median property tax also known as real estate tax in Sully County is 77200 per year based on a median home value of 7220000 and a median effective property tax rate of.

City Sales Property Tax Welcome To The City Of Brandon Sd

State Lodging Tax Requirements

Are There Any States With No Property Tax In 2022 Free Investor Guide

Property Tax South Dakota Department Of Revenue

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

Shocking Low Property Taxes In South Dakota Are In This County

How High Are Property Taxes In Your State Tax Foundation

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

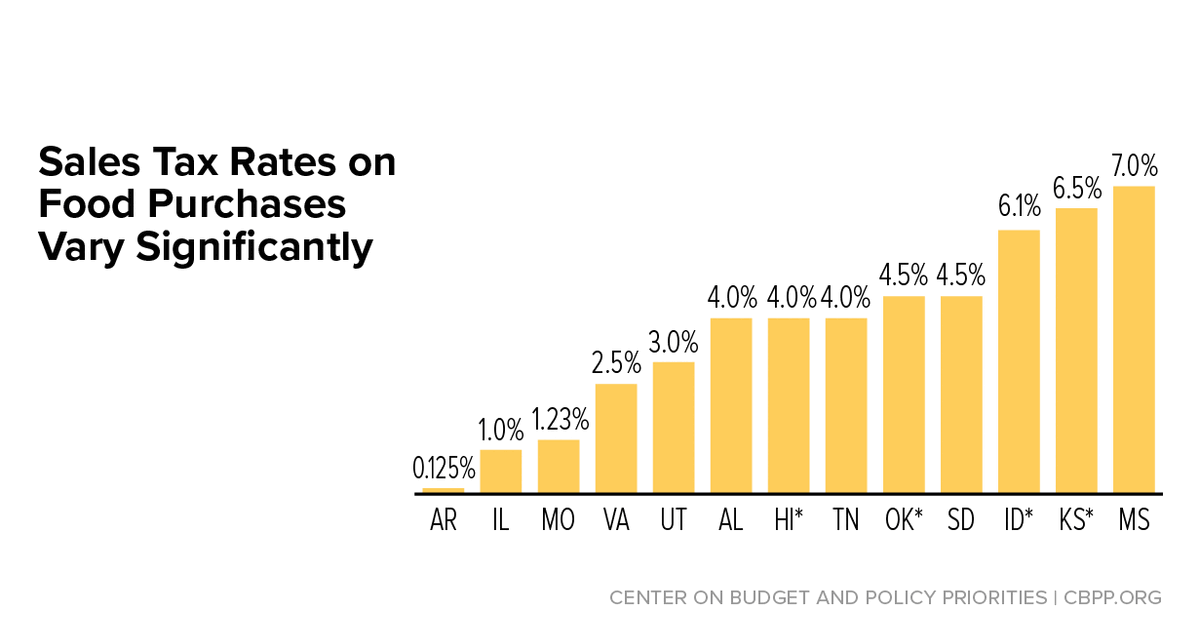

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How High Are Property Taxes In Your State 2016 Tax Foundation

Property Taxes By County Interactive Map Tax Foundation

How Are Property Taxes Calculated Plains Commerce Bank

South Dakota Property Tax Calculator Smartasset

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

State Tax Treatment Of Homestead And Non Homestead Residential Property